Advantages of project financing

Project financing has become a popular method for funding large-scale infrastructure projects, such as power plants, highways, airports, and industrial facilities.

Unlike traditional forms of financing, project financing offers several unique advantages that make it an attractive option for both investors and project developers.

In this article, we will delve into the key advantages of project financing and shed light on why it has gained prominence in the business world.

Please click here for more information: corporate tax accountant

- Risk Allocation and Mitigation

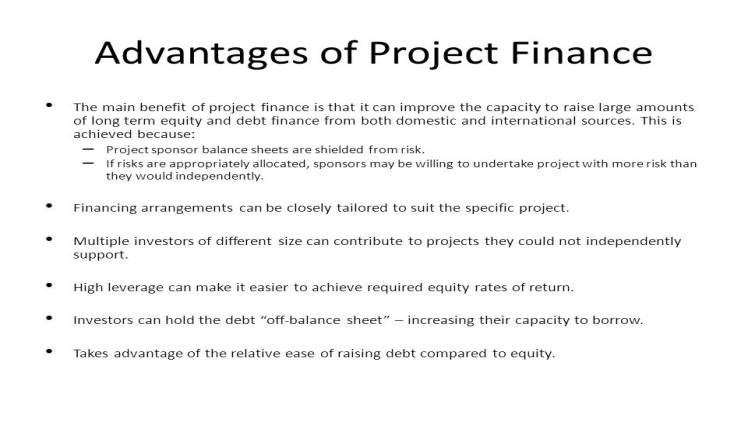

One of the primary advantages of project financing lies in its ability to allocate and mitigate risks effectively.

In project financing, risks are distributed among various stakeholders, including lenders, investors, and project sponsors.

This approach helps to minimize the potential impact of risks on any single party and ensures that each participant assumes a fair share of the risk.

Consequently, project financing provides a greater degree of risk protection and enhances the overall viability of the project.

- Limited Recourse Financing

Project financing often operates on a limited recourse basis, meaning that lenders have a claim only on the assets and cash flows generated by the project itself.

This setup protects the project sponsors from personal liability and shields their other assets from potential loss in the event of project failure.

Limited recourse financing attracts investors who are more willing to provide funding for high-risk projects, as their exposure is limited to the project’s specific assets and revenues.

- Enhanced Financial Capacity

Large-scale infrastructure projects often require substantial financial resources that may exceed the capacity of a single entity.

Project financing facilitates the pooling of financial resources from multiple stakeholders, including banks, institutional investors, and private equity firms.

This collective approach significantly enhances the financial capacity of the project and enables the undertaking of ambitious initiatives that may not be feasible through traditional financing avenues alone.

- Optimized Tax Planning

Project financing structures often incorporate tax planning strategies that allow for optimized tax benefits.

By utilizing specific legal and financial arrangements, project sponsors can capitalize on tax incentives, deductions, and credits available for infrastructure investments.

These advantages can help reduce the project’s tax burden, increase its financial attractiveness, and improve the overall return on investment.

- Off-Balance Sheet Financing

Project financing allows for off-balance sheet financing, which means that the debt incurred for the project does not appear on the balance sheet of the project sponsors.

Instead, it is accounted for in a separate project entity or a special purpose vehicle (SPV). This feature is particularly beneficial for companies seeking to maintain a strong balance sheet and credit rating, as it prevents the project’s debt from affecting their financial ratios and borrowing capacity.

- Long-Term Cash Flow Generation

Infrastructure projects typically generate long-term cash flows over an extended period. Project financing aligns with this characteristic by structuring the repayment schedule based on the project’s revenue-generating potential.

The repayment period is often linked to the project’s cash flow, allowing for a more manageable and sustainable repayment structure.

This arrangement mitigates the risk of sudden cash flow constraints and provides a stable income stream for investors.

- Expertise and Knowledge Sharing

Project financing often involves collaboration between different entities, such as project sponsors, lenders, and contractors.

This collaboration brings together diverse expertise and knowledge from various sectors, including finance, engineering, and operations.

As a result, project financing promotes knowledge sharing and facilitates the transfer of best practices and industry-specific expertise.

This collective knowledge can contribute to better project planning, improved risk management, and enhanced project outcomes.

- Flexibility in Structuring

Project financing offers a high degree of flexibility in structuring the financial arrangements. Each project is unique, and project financing allows for tailor-made financing solutions that suit the specific needs of the project.

This flexibility extends to the terms and conditions of the financing, including interest rates, repayment schedules, and collateral requirements.

The ability to customize the financing structure increases the likelihood of securing funding and ensures that the financial arrangements align with the project’s characteristics and cash flow projections.

- Access to International Markets

Project financing opens up opportunities for accessing international financial markets. Large infrastructure projects often require significant funding beyond the capacity of domestic sources.

By utilizing project financing, project sponsors can tap into global capital markets and attract investment from international lenders and investors.

This access to international markets provides a broader range of funding options, potentially lowering borrowing costs and increasing the likelihood of securing financing for the project.

- Alignment of Interests

Project financing aligns the interests of all stakeholders involved in the project. Lenders and investors have a vested interest in ensuring the success of the project since their returns are tied to its performance.

This alignment of interests encourages transparency, effective risk management, and a collaborative approach to project execution.

It also promotes accountability and drives all parties to work towards a common goal, resulting in improved project outcomes and long-term sustainability.

- Economic Development and Public-Private Partnerships

Project financing often plays a significant role in promoting economic development and fostering public-private partnerships (PPPs).

Infrastructure projects financed through project financing contribute to job creation, stimulate economic growth, and enhance the quality of public services.

Moreover, project financing encourages collaboration between the public and private sectors, leveraging the strengths and resources of both.

By bringing together public and private entities, project financing facilitates the implementation of critical infrastructure projects that benefit society as a whole.

- Asset Securitization

Project financing often involves the securitization of project assets, which provides additional security to lenders and investors.

The assets of the project, such as infrastructure facilities, revenue streams, or contracts, can be used as collateral to secure the financing.

This asset-backed approach reduces the perceived risk for lenders and investors, making the project more attractive and improving its access to funding.

It also enables the project sponsors to unlock the value of their assets and leverage them to secure financing on favorable terms.

- Transfer of Construction Risk

Large infrastructure projects often involve construction risks, including cost overruns, delays, and design issues.

With project financing, these risks can be transferred to the construction contractors or concessionaires.

By allocating the construction risk to specialized entities, project sponsors can mitigate their exposure and ensure that the project is delivered on time and within budget.

This transfer of construction risk reduces the financial burden and enhances the certainty of project outcomes.

- Encourages Innovation

Project financing encourages innovation by promoting the adoption of new technologies, sustainable practices, and efficient project management techniques.

Since lenders and investors assess the viability and profitability of the project, there is a strong incentive for project sponsors to incorporate innovative solutions that improve project efficiency, reduce costs, and enhance environmental sustainability.

The infusion of capital and expertise through project financing enables the implementation of cutting-edge technologies and practices that may not have been possible through traditional financing methods.

- Facilitates Long-Term Partnerships

Project financing often fosters long-term partnerships between various stakeholders involved in the project.

These partnerships go beyond the duration of the project itself and can extend to the operation and maintenance phases.

By fostering collaboration and trust, project financing encourages stakeholders to work together over an extended period, ensuring the effective management and ongoing success of the project.

Long-term partnerships can result in shared knowledge, continuous improvement, and the ability to leverage synergies for future projects.

- Social and Environmental Considerations

Project financing increasingly emphasizes the integration of social and environmental considerations into project development and operations.

Lenders and investors are increasingly interested in projects that demonstrate sustainable and responsible practices.

Project financing provides an avenue for incorporating social and environmental criteria into the financing structure, encouraging project sponsors to adopt measures that address environmental impacts, promote social inclusivity, and uphold corporate social responsibility standards.

This focus on sustainability aligns with the growing global emphasis on sustainable development goals.

Conclusion

Project financing offers several advantages that make it an appealing option for funding large-scale infrastructure projects.

Through risk allocation, limited recourse financing, enhanced financial capacity, optimized tax planning, off-balance sheet financing, and long-term cash flow generation, project financing creates an environment that promotes successful project execution and mitigates potential risks.

As more stakeholders recognize the benefits of project financing, its popularity is expected to continue growing, fostering the development of critical infrastructure worldwide.